PayPal customers often wonder how to borrow money from PayPal. If you follow the correct guide, then you will find the process to be quite simple.

Fortunately for you, you are in the right place to know ways to borrow money from PayPal.

PayPal is one of the well known platforms that have been serving the money transfer concept by facilitating the transfer of funds from one user to another.

Beside the fact that it allows its users to send and receive money conveniently, PayPal also offers financial aids to its customers by letting them borrow money from the platform.

Loans sometimes can be live saving since they have that ability to get us out of tough financial situations, but it is also important to have in mind that they come with disadvantages especially when you fail to repay the loan on time.

Another great option to obtain loans easily is Cash Advance apps, they allow you to get a cash advance before your payday.

Numerous PayPal users do not know that you can borrow money from PayPal since they are used to seeing PayPal as a platform just to send and receive money online.

Aside from Sending and receiving money with PayPal, you can do many other things among which getting a loan from PayPal is one of them.

Want to know how to borrow money from PayPal? then stay glued to this article as I will show you 7 different ways to borrow money from PayPal.

Table of Contents

Can I Get a Loan From PayPal?

Yes you can borrow money from PayPal. PayPal Working Capital is a business loan with one affordable, fixed fee. You repay the loan and fee with a percentage of your PayPal sales (there is a minimum payment required every 90 days).

There are no periodic interest charges, monthly bills, late fees, pre-payment fees, penalty fees, or any other fees.

How to Borrow Money From PayPal Account

At a given time in our lives, most of us fall in need of financial assistance for various reasons and PayPal flexible loan options can help you get out of difficult financial situations.

More to being an app that allows you to quickly borrow money, it fosters a tight relationship between customers and the company by providing a safe way to borrow money.

Though PayPal also offer loans, PayPal loans are not the same as regular bank or other financial institution loans.

Below are some of the point you need to follow in order to apply for a PayPal loan:

- You have the option to choose the appropriate amount of money for your loan.

- Next, you have to choose the dollar amount percentage of your PayPal sales you will repay with the loan charges fee.

- If PayPal approves your amount and process it, you will be able to get your funds in the space of minutes.

ALSO READ: How to Borrow Money From Venmo [Complete Venmo Loan Guide].

How Much Money Can You Borrow From PayPal?

With PayPal, you have an available feature that allows you to obtain an instant loan, but there is a restriction on the amount of loan you can seek based on your PayPal history, but it is far more than what other platforms, such as Cash App have in stock.

You are able to borrow up to 35% of your annual PayPal sales on your first 2 working capital loans, up to a maximum of $125,000.

This means that for a borrower with $100,000 in annual PayPal sales, you can get a maximum loan of $35,000.

Best Ways to Borrow Money From PayPal

PayPal takes part in a number of initiatives around the world, some of which are in partnership with local governments. to help small businesses thrive and empower local people through the use of company loans.

PayPal most popular lending type are small business loans and they do not offer personal loan options.

Below are some of the most effective ways to borrow money from PayPal:

1. Borrow Money Through PayPal Line of Credit - Buy Now, Pay Later

PayPal credit is a reloadable credit line that can be used at any of the numerous merchants that accept PayPal.

Purchases made through online banking can be made without the use of a credit card. Similar to those charged by typical banks, late fees are imposed on consumers.

- When you make use of PayPal Credit to pay for an order of $99 or more, you can enjoy zero interest if you pay in full within 6 months.

- You will charged by PayPal at a rate of 19.99% APR from the day of purchase if you do not settle your account within 6 months.

- Provided that the balance is not paid in full during the promotional period, interest will be charged to your account starting on the date of purchase.

- If you are accepted, PayPal will provide you with a $250 credit line to begin with.

- You may incur a late fee of $40 if you miss a payment but the amount may be lower if its your first time.

ALSO READ: How To Get The Borrow Feature On Cash App.

2. Get PayPal Small Business Loans For Your Company

For every PayPal individual that looks forward to establishing their own company, then PayPal Small Business loan is suitable for them.

The main aim of this loan is to help young entrepreneurs with bad or no credit to get started. But getting this loan, you must answer a 5-10 minutes online questionnaire, which is then used to modify estimated loans.

- It offers low-interest fixed fee small business financing with amounts ranging from $5,000 to $500,000.

- In order to avoid paying interest, you can pay off the loan over time by charging a percentage of your PayPal sales.

- Whenever a Payment is returned, a $250 Returned Fee is applied in addition to the total loan fee.

- If PayPal loan is available in your nation, you can apply for it for your small business, but it must be used for purchase rather than cash advances.

- If you are repaid by PayPal, you must be cautious. You will be charged a fee if the person who repays you presents the transaction as a commercial transaction.

3. PayPal Credit Cash Advances

You can get a cash from your credit card via PayPal credit cash advances. However, you must pay off your expenses in full each month to avoid paying interest. On PayPal, Credit cash advance interest payment will be deferred until the conclusion of the monthly payment term.

- When you use PayPal Credit to send money to friends and family, you’ll pay a 2.9 %fixed fee plus $.30 for each transaction

- For cash advances and regular purchases, PayPal Credit has a single APR of 26.24%

- Use PayPal Credit to send money to friends and family, you’ll pay a 2.9 % fixed fee plus $.30 for each transaction.

- Credit card cash advances have no grace period; however, a PayPal credit cash advance has a grace period of up to 25 days, so interest does not start accruing almost immediately.

- This price is lower than what most credit card issuers charge for cash advances: typically 3% to 5% of the advance amount, plus a $2 to $5 fee if you withdraw cash from an out-of-network ATM.

4. Small Business Lending

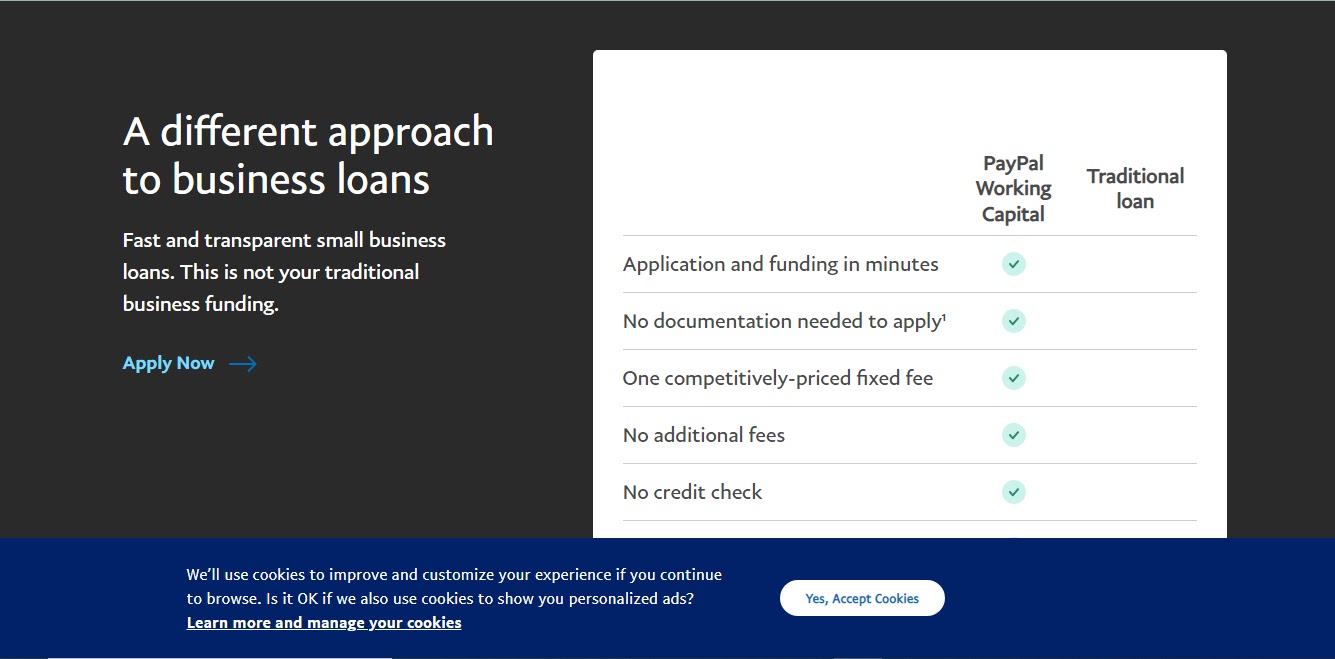

PayPal is trying to close the funding gap by offering PayPal working capital loans, which is a unique and useful source of information for small enterprises.

In order to be eligible for a PayPal Working Capital loan, you must have a PayPal Premier or PayPal Business account that has been open for at least 90 days.

- You can choose a loan or cash advance amount of up to 18% of your yearly PayPal sales to start a business, with a percentage range of 10% to 30%.

- You cannot obtain personal loans from PayPal, but you can obtain a variety of finance options for both individuals and businesses.

- Among typical lending choices, PayPal working Capital stands out since you can be funded in minutes, while the loan others receive has a single flat cost to repay rather than an interest rate.

- You will receive more donations if you have a larger number of participants. People want to assists, and anyone may support your 0% interest loan by donating $25 to Kiva.

- PayPal can approve an disburse cash relatively rapidly without performing a credit check or demanding a personal guarantee or collateral because the loans are based on PayPal customers' account history.

- How To Get Money Back From Venmo If Scammed

- Can You Get Scammed on Cash App Sugar Daddy?

- Why Doesn’t My Cash App Have The Borrow Option [Everything to Know]

- How To Verify Identity On Cash App [Complete Guide]

- How To Transfer Money From Varo To PayPal [Complete Guide]

- How To Transfer Money From PayPal To GCash

- How To Send Money From PayPal To Chime [In 3 Easy Steps]

- How To Send Money From Zelle To PayPal [Complete Guide]

- How To Send Money From Cash App to PayPal [Complete Guide]

- How To Get Money Back From PayPal If Scammed [3 Easy Ways]

5. Paycheck Protection Program (PPP) Loan Basic - LoanBuilder By CARES

The Paycheck Protection Program was established by the Coronavirus Aid, Relief, and Economic Security (CARES) Act and is a lending program that rivals Fiona Loans in terms of quality.

It is a $350 billion project with a 1% interest rate that was created to give American small businesses cash flow support for eight weeks.

- If utilized for qualified, approved expenses, up to 100% of the total loan amount and accrued interest can be forgiven.

- The PPP loan has a five-year term and a fixed interest rate of 1%. There is no fees, and there is no need for a personal guarantee or collateral.

- In conformity with SBA requirements, payments will be postponed.

- You can borrow up to 25% of your PayPal sales from the previous year. For loans, you need to select the percentage of your future PayPal payments that you want to use.

- Paycheck Protection Program loans are available to all small enterprises, independent contractors, and self-employed individuals.

ALSO READ: How to Borrow Money From Cash App [Complete Guide].

6. Lend Money Through Kiva Lending Team Collaboration With PayPal Customers And Affirm

Since its establishment, Kiva has relied on PayPal as its principal online payment processor. It is a non-profit that provides loans to businesses that would otherwise be unable to receive funding.

You can execute every loan made through Kiva without collecting any transaction fees, by working with the other Kiva cofounders.

- Employees must first make a loan with their own money to obtain a $25 credit to make another loan.

- Kiva never charges lenders a fee, so all of the money you lend on Kiva goes directly to funding borrowers’ loans.

- There is no catch when it comes to 0% interest.

- Affirm, a lending startup company created by PayPal and Yelp co-founder Max Levchin offers a simple loans for web purchases.

- Also, Affirm gives you a fixed interest percentage rate upfront for each purchase, ranging from 10% to 30%, and tells you exactly how much you’ll end up paying.

7. Consumer Groups Take PayPal to Task Over Student Loan

Students who use a PayPal credit line may be subjected to excessive interest rates by some for-profit professional schools.

At tiny vocational schools and technical schools, the majority of which are not accredited, students can pay tuition with PayPal Credit.

- The line, which functions similarly to a credit card but does not require the use of plastic, has a current interest rate of around 24%.

- It typically provides loans with a six-month interest-free term.

- The borrower will be charged interest retroactively if the total amount is not paid by the end of the campaign.

- Moreover, there is no interest if the card is paid up in full within 6 months.

- The company encourages people to use their credit cards for online purchases.

Can You Get Personal Loan From PayPal?

No, you cannot get a Personal loan from PayPal though it provides many types of funding to individuals and businesses but not personal loans.

For these type of needs, you will have to look into Monevo, Stilt, Even Financial and other options.

As small business owner, you can also acquire a loan to start your business by using a working capital loan or a small business loan.

By making use of a regular credit card, regular customers can receive rewards points and a credit line.

How to Get PayPal Cash Advance?

Using your PayPal account, you can get a Cash Advance. First and foremost, you must select Send Money as your payment method. After you’ve authorized PayPal, Inc., you’ll be given credit for the Cash Advance Cost in the amount of the Cash Advance.

Then, by selecting the Send Money option, you may use the Send Money tool to send the Cash Advance Cost to the receiver.

Final Thoughts: How to Borrow Money from PayPal

If you find yourself in a difficult financial situation and you need money, choose a safe option and sign up a PayPal loan agreement. This is one of the widely used systems for payments and loans by merchants.

PayPal sales, your previous PayPal history, and other factors influence the maximum amount of money you can borrow. The number of possible ways to borrow money, as well as significant elements of each strategy, are mentioned above.

Frequently Asked Questions

What is the procedure for obtaining a PayPal cash advance?

If you want to send money through PayPal, you can use your PayPal Extras card as a funding source. By dialing the number on the back of your Extras card and requesting a PIN for ATM withdrawals, you can acquire a cash advance on your card.

How do I get a PayPal overdraft?

PayPal does not yet provide an overdraft facility. It does, however, provide Paypal Credit, which functions as a credit card.

Is it possible to overdraft a PayPal cash card?

Your PayPal prepaid card cannot be used to overdraft. The card does, however, have a buy cushion program that allows for up to $10 in overdraft purchases at the bank discretion.

What is the maximum amount you may borrow from PayPal?

With a maximum borrowing amount of $125,000 for the first two loans and up to $200,000 for future loans, PayPal Working Capital can support up to 35% of your annual PayPal revenues.

Is it possible to borrow money through PayPal?

You can determine the amount of your loan from the comfort of your own home. You can borrow up to 25% of your PayPal sales from the previous year. Furthermore, you can pay off the loan in full with no early repayment fees. You can do this by using your PayPal balance or a confirmed bank account.